The Non-Admitted and Reinsurance Reform Act (NRRA) was signed into law by President Barack Obama on July 21, 2010, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The bill, which includes language to standardize the reporting, allocation, and payment of surplus line insurance premium tax on multi-state risks, will take effect July 21, 2011. In response, the California Legislature enacted NRRA conforming legislation in AB 315 (Soloria).

Below are some quick links to aid you in complying with the new rules and regulations set forth in the above-mentioned legislation. Please click on the topic to quickly take you to the information you need.

Video of the NRRA Webinar that was hosted by the SLA of California on July 19th:

NRRA Webinar

NRRA Webinar

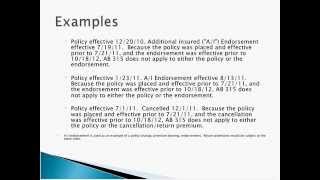

Slideshow from the NRRA Webinar that was hosted by the SLA of California on July 19th: Click here

Memorandum issued by Ted Pierce, Executive Director on July 18, 2011, on NRRA/CA AB 315: Click here

Surplus Line Insurer Lookup

AB 315

NRRA

New Broker Filing Manual

ECP Checklist

Coversheet

New D-1

New D-2

This information is provided by the Surplus Line Association ("SLA") in its capacity as a trade association. This information is not provided on behalf of the California Department of Insurance ("CDI"), nor is it provided by the SLA in its capacity as the CDI's advisory organization.

This information should not be considered legal or tax advice; it is recommended that surplus line brokers seek professional legal and tax advice on these important matters.